IRS:

| Automated Refund Status: | 1-800-829-1954 |

|---|---|

| Live customer service rep: | 1-800-829-0582 ext. 652 1-800-829-1040; select language, 2, 1, 3, 2 |

| Order Transcripts: | 1-800-908-9946;1-800-829-3676 |

| IRS Treasury offsets (non-tax debts, student loans, child support): | 1-800-304-3107 |

| Specialized Unit (IPSU)- ID Verify: | 1-800-830-5084 |

| Reference Code 1541: | 1-800-829-0582 ext. 312 |

| Amended Returns: | 1-800-829-0582 ext. 633 |

| Taxpayer Advocate Service: | 1-877-777-4778 |

- Where’s my refund:

- Check the status of amended return:

- Client Intake Form:

- Receive correspondence from the IRS/State?

- If you’ve already completed a client intake form but need to submit additional information for your tax return:

ID VERIFICATION:

The IRS has recently implemented a system where they require identity verification for any tax return that mimics the pattern of identity theft. You are at a higher risk of being required to verify your identity if any of the following have changed since your previous tax return filing:

- Address

- Income

- Name

- Employer

How will I know I’ve been selected for ID verification?

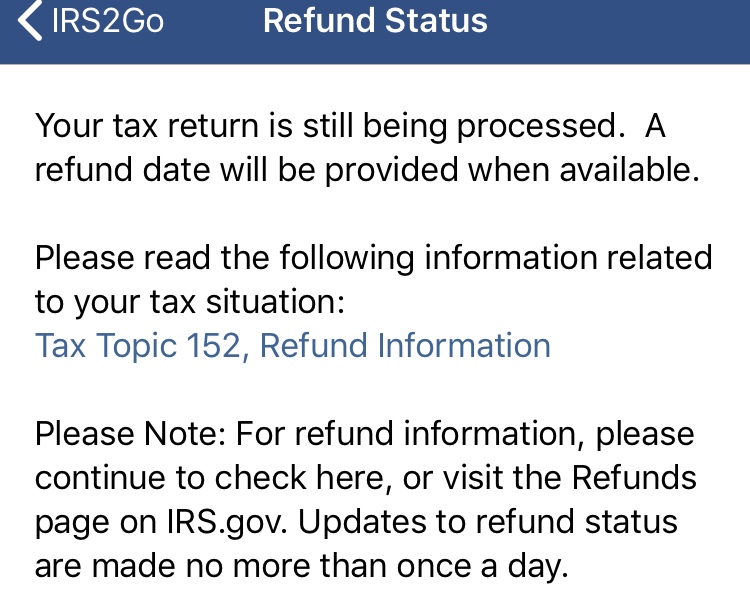

- If your refund status looks like the photo posted below after 21 business days of your tax return being ACCEPTED, and you have not received your refund, you may be required to verify your identity.

- The IRS typically sends you a letter, however if you have not received your refund or a letter, and it has been 21 business days since your tax return was accepted, you should call the IRS and speak to a representative; 1-800-829-0582, ext. 652.

What to do if you’re selected for ID Verification:

- Call the telephone number listed on the letter you received from the IRS. **Make sure you have your current year tax return and previous year tax return in front of you**

- Answer all questions accurately-ask questions if you don’t understand what is being asked of you.

- Once your identity if verified, the IRS should continue to process your refund within 6-9 weeks unless further investigation is required.

Below you will find links to tax resources for all states, if you need further assistance, do not hesitate to contact us with the inquiry form on this page.